It’s been long predicted that gin’s meteoric rise over the past fifteen years would one day be followed by some sort of decline. Some in the industry have taken to calling this moment “peak gin” and many believe that in some parts of the world— especially the UK— we’re already past that point.

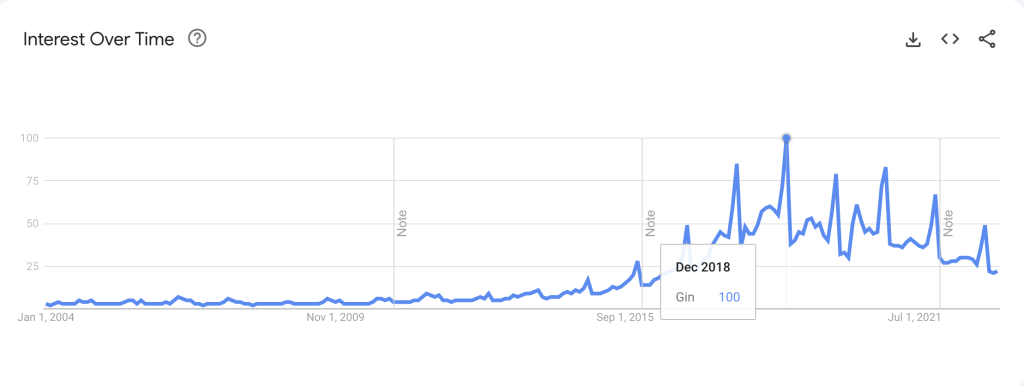

Though some remain bullish and project 11% annual growth in the UK market in the next five years, others see the pattern that perhaps is best illustrated by Google Trends— that interest in gin in the UK has trailed off precipitously from it’s late ’10s peak. Revenue has trailed off more modestly, but it has begun to taper.

Prognostications for gin growth in the United States have always been more modest. For example, growth through 2027 is predicted to be a mere 3.8% annually. However, many have seen the United States as a market where the gin scene had not reached its saturation point. In other words, if the U.K. was seeing a bit of a backlash, the U.S. was still ripe with opportunity for gin distillers.

“Peak Gin” in the United States, many thought, was many years away.

However as bullish as I remain on gin personally, there are starting to be some warning signs that the U.S. might be in for a bit of a downturn in the category.

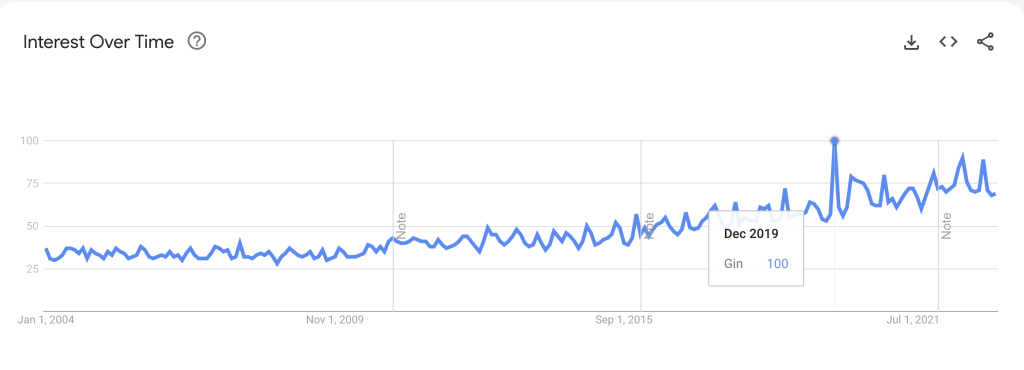

The first sign is again in Google Trends. Search interest in gin peaked in 2019. Interest in gin peaks every December for the holidays. Since then, gin continues to peak each year at the same time; however those peaks mirror what was seen in the U.K. Trends report. They’re beginning to descend.

Further, despite projections of growth, sales have slightly dipped. These declines in both external sentiment and sales numbers are at least worthy of attention. The National Alcohol Beverage Control Association saw an 5.6% year over year decline of volume in control states, but a modest 0.2% increase in value.

Distillers, especially smaller craft distillers who are aiming at the more premium end of the market can take solace in that increase. While the overall category is showing evidence of a potential downturn, the decline of inexpensive brands is more than being made up for with increases in sales numbers for more premium offerings.

In 2021, one report saw “the leading gin brands above $25 a 750-ml. grew by 11.3%.” Impact Databank saw growth in 2022, with “super-premium” brands experiencing double digit growth. Gin outpaced other spirits in demand on premise in 2022.

Beyond the growth in 2021 and 2022, projections for this market segment remain bullish.

Moving forward, in a post peak-gin world

The path forward appears to be one of “quality over quantity.” Storytelling and innovation offer distillers an opportunity to distinguish themselves within the space, as consumers are showing a willingness to pay for these experiences. Half of U.S. Gin sales now come from these segments.

Many of the leaders of this growth are brands like Hendrick’s, The Botanist and Empress 1908.

However discouraging it might be to see that consumer interest might be showing signs of veering elsewhere, overall gin distillers can continue to take solace in the segment’s value growth and the shift in consumption trends that might suggest “buying less,” but “buying better.”

Gin is indeed still in; however, it’s just “in” in a different way.